A credit score of 650 would be considered fair and falls within the "good" category. Even though your credit score may be low, you still have the possibility of being approved for a home or car loan. Keep reading to learn if you're eligible for a loan with a low interest rate. These are some tips to help you improve your credit score and get approved. When you have a credit score above 650, it is possible to apply for a credit-card.

Fair Credit Score is 650

If you have a great credit history, you can qualify for a credit card with a score of 650. You should repair your credit history if your score is lower than that. It is important to pay your bills on time, and not overspend. Regular payments will improve your credit score. It is also important to avoid using too much credit and try to stick below 30% of your available credit.

Even if the credit score you have is not high, you still can get a good interest rate if payments are made on time. This is a great way to increase your credit score. But, you should not be a cosigner for any loan. This could cause credit damage. If you default or miss payments, it will affect the credit score of your cosigner.

650 credit score is on the lower end of the "good" range

A credit score below 650 is considered to be low-end credit. You can still get a loan and credit card at this score. But you should know how you can improve it. A credit score of only 650 can seem very low. However, it is possible to significantly increase your score in a relatively short time. You may be able boost your credit score in just a few weeks if you are able to pay large debts.

Although a credit score 650 is better that a credit score 300, it's still significantly lower than the highest score of an 850. The credit score is considered to be in the "fair range", which means it's possible to get a mortgage with a credit score of at least 650. Unfortunately, a credit score below 650 won't make it easier to get new lines or credit. It could also affect your quality life.

Credit scores of 650 or higher can qualify for a 0% home loan

If your credit score is less than 650, you might still be eligible to receive a 0% home mortgage. It's important that you understand that an adjustable-rate loan (ARM) is likely to be offered to your household. This type is a loan that has a fixed interest rates for a period of time. For example, it may have a rate of one, three to five, seven or even ten years. This type can pose risks that are difficult to manage.

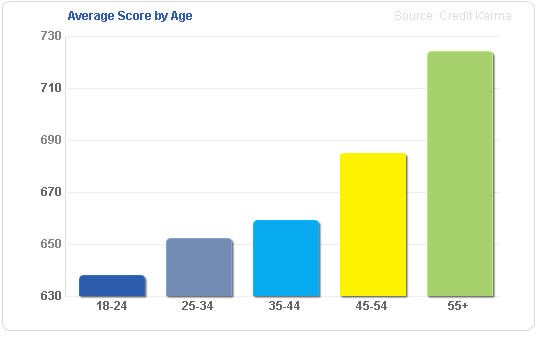

A 650 credit score is considered fair, and many people have credit scores in this range. This can make it hard to get credit approval. There are many ways to improve credit and get the best terms and conditions. It is important to pay on time.

Applicants with 650 credit ratings can get a 0% auto loan

A credit score of at least 650 is sufficient to be eligible for a car-loan. Your credit score has a great deal to do with your interest rate, so trying to improve it is crucial. Luckily, there are several ways to improve your score. The first is to make a larger downpayment. A large down payment will show that you are responsible. This can also help lower your interest.

Credit cards are another way to increase your score. You should also make sure you pay the monthly balance. A credit card can improve your credit score, while making it easier to obtain a 0% loan for your car.