There are many things you can do to improve your credit score. Two of the best ways to improve your credit score are to pay off your debts and dispute inaccuracies on your credit report. While these actions will improve your score over time but may take months to see the benefits, it could be years before you notice any changes.

It is important to pay bills on time

If you want to raise your credit score, it's important to pay your bills on time. Late payments can reduce your credit score by as much 100 points. Automatic payments are possible, which can help avoid missing payments. Some credit card issuers provide email alerts to remind customers to pay their bills on time.

Paying your bills on time accounts for approximately 35% of your score. Automated payments can be made by your creditors. These transfers move money from your bank account to theirs prior to the due date. It can take up to two days to process the payment.

It is essential to pay your bills on-time in order to improve your credit score. Late payments will remain on your credit reports for seven and a quarter years. Make sure to pay your debtor promptly if you miss a payment. It's also important to ask them to stop reporting missed repayments. You will see a decrease in your credit score the more you miss a payment.

You can dispute inaccuracies in your credit report

If you have errors on your credit report, you have the right to dispute them. You can write to the credit bureaus and explain to them why the information on your report is inaccurate. It's also important to provide documentation to back up your claim. A copy of the account statement is also helpful if you are unable to pay on time.

While your credit score will not increase overnight, it can improve over time. The average Credit Strong account holder saw a 25 point increase in three months. And in nine months, they had an increase of 40 points.

Not disputing inaccurate information in your credit report can be difficult. Your credit score will be affected by how long it takes credit bureaus to investigate your claim. If you dispute inaccuracies on your credit report, the bureaus must correct or delete the information within five days. You can also opt to receive automatic payments, which will save you time. By doing this, you can lower your average age of accounts, which is a factor in your FICO score.

Maintaining a steady payment plan

A steady payment plan on credit cards can be one of the best ways you can raise your credit score. FICO (and VantageScore) credit score companies view your payment history as the key factor in determining you score. Because timely payment of your credit card bills shows that you can repay the loan, this is why credit score companies like FICO and VantageScore consider it an important factor. To improve your credit score, you should make all your credit card payment on time.

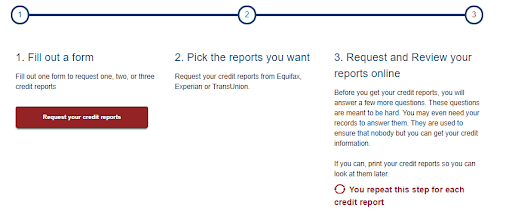

Your credit scores are critical as they will determine your eligibility to obtain excellent loans or financing. A low credit score can severely limit your options. Equifax, Experian and TransUnion are the three main credit bureaus. They analyze your financial information and habits to determine your score. Be patient when trying to raise you score.