You may be wondering what to do if you want to improve your credit score. If you have bad credit you may be able to ask a close friend or family member for a co-signer. This option is risky and will require full responsibility as they will be responsible for repayments. This option is not for everyone.

Pay off overdue accounts

For credit to be restored, you need to pay off past due bills. The largest factor in your credit score is payment history. Late payments can be a problem for up to seven years. They are also more difficult to erase from your credit report. You should also be aware of your credit utilization. This is the sum of all your outstanding credit card and loan balances. You are much more important to pay your bills on time than you are to make late payments.

Your credit score will not be affected if you pay your bills on the due date. Your credit report will show seven years of missed payments if you have multiple. You must make payments on all overdue accounts if your goal is to rebuild your credit rating. This is best done by making minimum payments on all accounts. You can make extra payments on high-APR debts as often as possible, and you can do the same with all other debts. Late payments can damage your credit score, so make sure you keep up with all past due payments.

Avoid late payments

To avoid late payments when rebuilding credit, you have to start by reviewing your credit report for inaccuracies. By calling the credit bureaus, you can correct incorrect information. It is easy and fast. It is fast and free. While it is tempting to make only the minimum monthly repayment, making a larger monthly payment will reduce interest fees.

Setting up automatic payments is one of the best methods to avoid late payment when rebuilding credit. An automatic payment can be set up to provide the money you need to pay your monthly minimum bills. You can make automatic payments to all your accounts, if you are able, so your bill is always paid on time. You can also use multiple credit card if you are unable to do this.

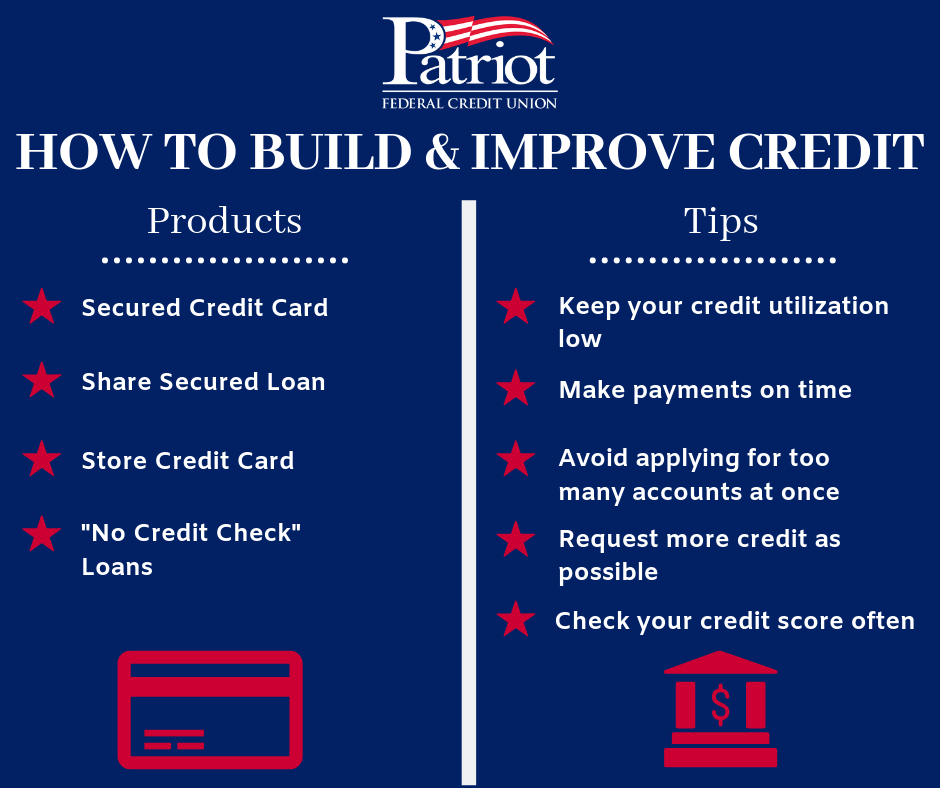

Increase your credit score with a secured card

A secured credit card is a great way to improve your credit score. These cards are designed for those who are rebuilding their credit but don't have the same credit score as traditional credit cards. Lenders view those with low credit scores and require cash deposits before they approve them. This reduces the bank’s risk of defaulting and helps to keep the bank solvent.

Your credit score depends on many factors. These include your payment history (both past and present), length of credit history and types of credit that you have used. Because they report your payments directly to the major credit bureaus, secured cards can help you build positive credit histories. The best way to make sure you're building a strong credit history is to make on-time payments on your secured credit card. Keep the balance low. A secured credit card can be used for everyday purchases. But, don't exceed your credit limit. This will make you appear credit-hungry to banks.

Prior to rebuilding credit, you must pay off your medical debt

Your credit report won't reflect medical bills. Therefore, you should pay your bills before rebuilding your credit. There are some caveats to remember. These debts will not hurt your credit score. In fact, hospitals make very little money from selling your debt to a collection agency. Hospitals are more likely to negotiate a payment arrangement or accept part of the payment in this instance.

One major benefit of paying off medical debt before rebuilding your credit is the reduced impact on your score. Although the negative mark on your credit history will show up, it may take longer for the marks that appear to be corrected. You will also have the medical bills on your credit reports for seven years. These debts can prevent you getting loans or credit cards. They will also make it more difficult to hire. Even though medical bills may not be a major issue on your credit report they can affect your credit score by as much as 100 points.