There are several different options for credit cards for bad credit. This article will discuss a few of them. These include Reflex Mastercard and Credit One Visa. Each offer different benefits and can help establish solid credit histories. Each card is different and has its own requirements.

Discover it Secured Credit Card

You might consider the Discover it Secured Card Credit Card if you have poor credit or are looking for a credit card. The card comes with a high interest rate and requires a security payment. If you can't afford to pay the full amount each month, this card may not be a good option for you. This card may be a good option if you are trying to rebuild your credit.

The cash back feature of the Discover it Secured card is one of its best features. The cash back rewards range from 1% to 2% and are based on where you spend your money. The card also allows you to redeem your cashback rewards for a variety of different items. Cashback can be as high as $1,000 per quarter for gas purchases.

Credit One Visa

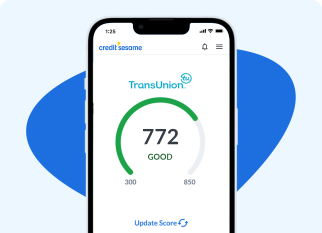

The Credit One Visa may be right for you if you have low credit scores and are in search of a credit card. This credit card offers low annual fees and rewards on purchases of common items. Its main purpose is to help you rebuild your credit, so you should make all your payments on time. Credit One sends credit bureaus your timely payments, which will increase your credit score. Credit One offers online tools that help you monitor your credit score and get a free credit report summary.

Secured credit card are the best credit options for people with poor credit. These cards require a deposit before they will issue the card, which protects the issuer in the event of nonpayment. If you close the account, your deposit will be returned. This can help to avoid paying large amounts on your card. While these cards are very easy to obtain, they may not be approved for all applicants. You may not qualify for one of these cards if you have serious credit problems or a bankruptcy.

Reflex Mastercard

Reflex Mastercards are a great option for people with limited credit. This can help to improve your credit rating and create a list of responsible cardholders that will enable you to receive better terms. These cards come with strict terms and high fees. A credit application is required to obtain the Reflex Mastercard. You will need to submit basic financial information such your Social Security Number as well as your annual income.

Although the Reflex Mastercard might not be the best card for everyone, there are many perks that make it great. Reflex offers monthly credit score updates and helpful tools to help you work your way up the credit ladder. You should note, however, that it can be very expensive for some people. It is best to compare prices before making a commitment. Secured cards, such as those issued by a bank or credit union, may offer similar benefits. These cards may require you to make a deposit of security before being approved. Secured cards usually have lower interest rates, and there is no annual fee. You may consider this option.

Celtic bank

The Celtic Bank credit card is a good option for people with bad credit. There are many types of credit cards offered by the company, with very favorable terms. These cards are a great way to increase your credit score quickly. The bank is reliable and offers great deals. Although anyone can apply for a Celtic Bank credit card, it is crucial to read the conditions and stipulations before making a decision.

Celtic Bank's Reflex Mastercard card is a credit line. The card comes with a low credit limit and a high interest rate, but if you pay off the balance every month, the interest rate will reduce. This card is not suitable for people who have been late paying or have a history. Credit protection programs are available. The first year maintenance fee is waived.