While Capital One credit cards for bad credit offer many advantages, there are several factors you should consider before applying for one. First, it is important to understand the workings of a Capital One creditcard. The credit line will be increased only if the cardholder maintains a low balance. However, if you have a high balance on your Capital One card, you may not qualify for an increase. A perfect payment record is also required. Failure to pay on time or with credit reports that are negative may result in you being disqualified.

Capital One QuicksilverOne Credit Card Cash Rewards

Capital One QuicksilverOne cash Rewards credit card is a good choice for those with bad credit. This card can improve your credit score, even though it has a high APR. As long as you make your monthly payments in full, you will be fine. Capital One has a CreditWise Program that will give you tools to manage your credit score. When you have made five timely payments you will automatically be eligible to apply for a higher-credit line.

The QuicksilverOne cash Rewards credit card may be an option for those with good credit but it might not suit everyone. If you have a poor credit history, it might be best to apply for a secured or starter card instead. Both of these cards will help you build your credit. Capital One's QuicksilverOne Cash Rewards credit card has low fees and many useful perks, making it a good option for people with less than perfect credit.

Capital One Platinum Secured Card

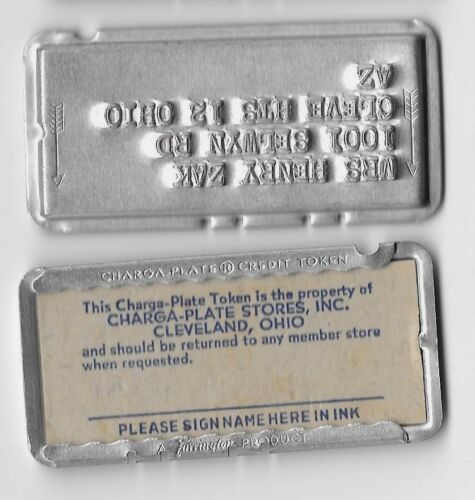

Capital One Platinum Secured Card is credit card that helps people with bad credit build their credit. An applicant must make a security deposit to open an account. The credit limit will not be affected by the security deposit. Credit limits can be raised if your credit score improves. You can deposit as little $49 as well as as much as $1,000.

Capital One Platinum Secured accounts can be opened and you can increase your credit limit simply by making regular monthly payments for six month. Your credit rating may improve over time, and you may be eligible for a higher credit limit. But, you must keep in mind that you can only spend what you have to pay back.

Capital One Quicksilver Students Cash Rewards Credit card

Credit cards that offer good rewards are a great option for people with poor credit. The Capital One Quicksilver Student Cash Rewards credit card is an excellent choice. The credit card comes with a 100% cash-back guarantee for all purchases. This card doesn't charge annual fees which is always a bonus.

The Capital One Quiksilver Student Cash Reward credit card is a great choice because it offers a solid way to build credit as well as no foreign transaction fees. Students studying abroad or already in college will find this card to be a good option.

Capital One Quicksilver Secured Card

If you have poor credit and need a credit card, a Capital One Quicksilver Secured Card may be the right option for you. The cards require you to pass a soft credit screening. This means you can earn back your security deposit. It's a fantastic way to begin building your credit rating.

This credit cards offers a 1% cashback rebate on all purchase and can be upgraded to an unsecured card once you have built up credit. While the Capital One Quicksilver Secured Card offers few benefits, it is a good choice for someone with poor credit.