You are not the only one looking to improve your credit score. It is important to improve your credit score for many reasons, but it can be hard to know where to begin. There are a few ways that you can quickly build your credit. These include making timely payments, applying to several credit cards and borrowing a loan in order to build credit.

Making timely payments

Your payment history is a key factor in determining credit score. It accounts for 35 percent of your credit score, and it is therefore important to make on-time payments whenever possible. Automatic payments can be set up to pay all your bills. They automatically debit your bank account from the due date. You don't have any additional money to cover the payment.

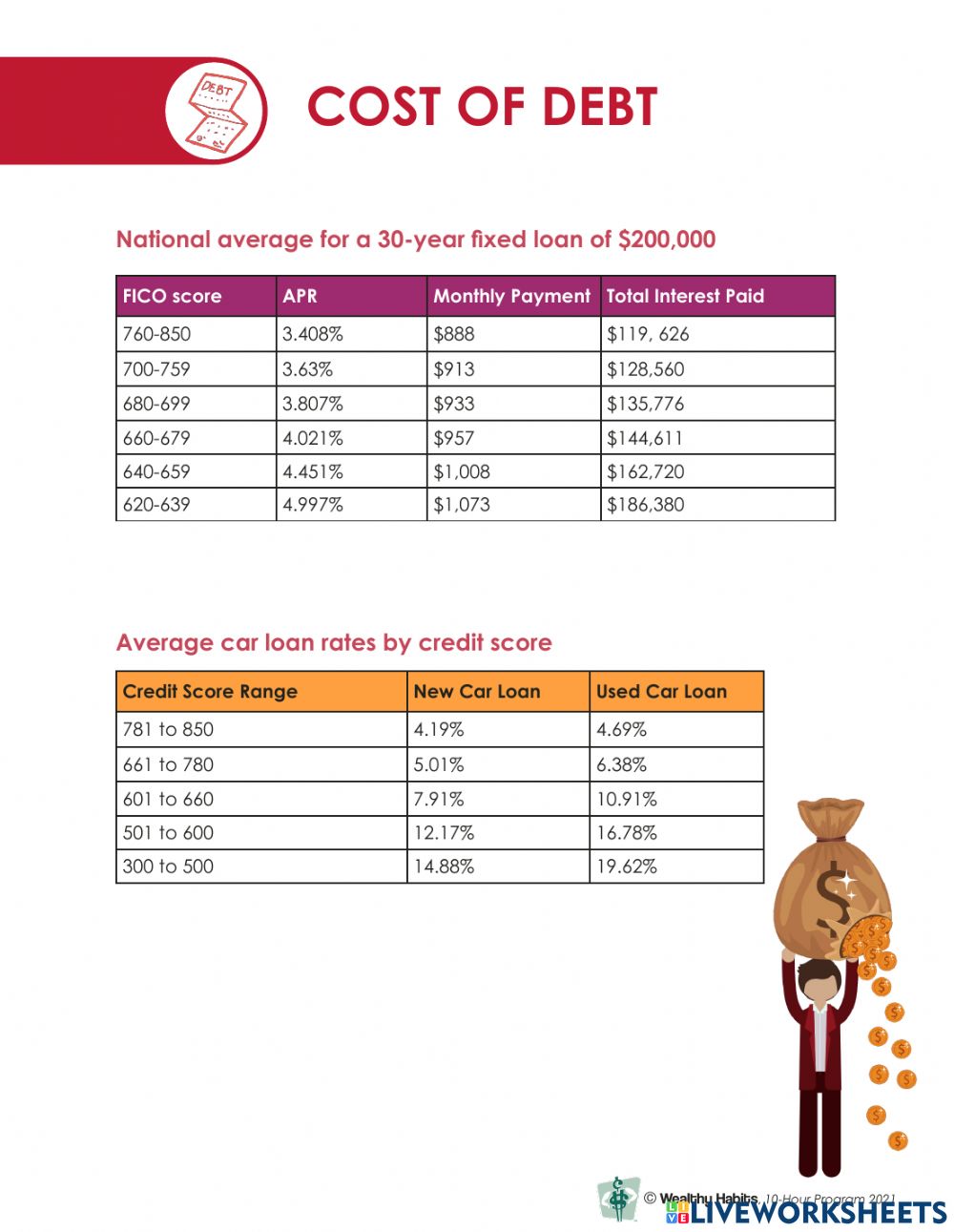

You can also build credit by getting a personal loan. This type of loan is not easy to get, but it can be very beneficial in building credit history. You should only borrow what you are able to pay back. Your credit score is affected by missed and late payments.

A secured credit card

You can build your credit by getting a secured card. This type of card requires that you provide a cash deposit as collateral. In return, the card will be allowed to be used for purchase. Late payments may result in the issuer removing your deposit.

When you start using a secured credit card, you will soon begin to see your credit score rise. If you keep your balance low and make your payments on-time, you will see a rapid improvement in your credit score. Once your credit history is strong enough, you may be able to move on to an unsecured card with lower fees and better rewards.

Multiple credit cards

Multiple credit cards can help you build your credit. Most credit card applications follow similar steps and require identifying information like your date of birth and Social Security number. After that, you'll need to go through several stages including a credit screening. Here are some points to remember while applying for credit cards. First, provide as much detail as possible.

Although multiple credit cards may help improve your credit score it might not be the best method to build it. If you have too many credit inquiries or high balances on your cards, it could lower your credit score. It is possible to accumulate too much debt, which could lead to a higher utilization ratio.

Credit building: Taking out a loan

Many credit unions and banks offer loans for people trying to build credit. You should remember to report any loans to credit bureaus. You should not borrow more than you are able to pay back. In addition, if your goal is to build credit by taking out a personal mortgage, you need to ensure that all payments are made on time. A late or missed payment can cause credit scores to plummet.

A good credit rating can help you obtain new credit quickly and at the most attractive rates. It's not easy to raise your credit score. Building credit takes time, so it's essential to stay on top of things and make timely payments to keep your score high.