The amount of credit cards that a person should have varies from one person to another. It will depend on your financial status and how you manage your debt. It also has a big impact on your credit score. Your credit score is an important factor in your ability purchase big-ticket items or a mortgage.

Do not apply for too many credit card at once

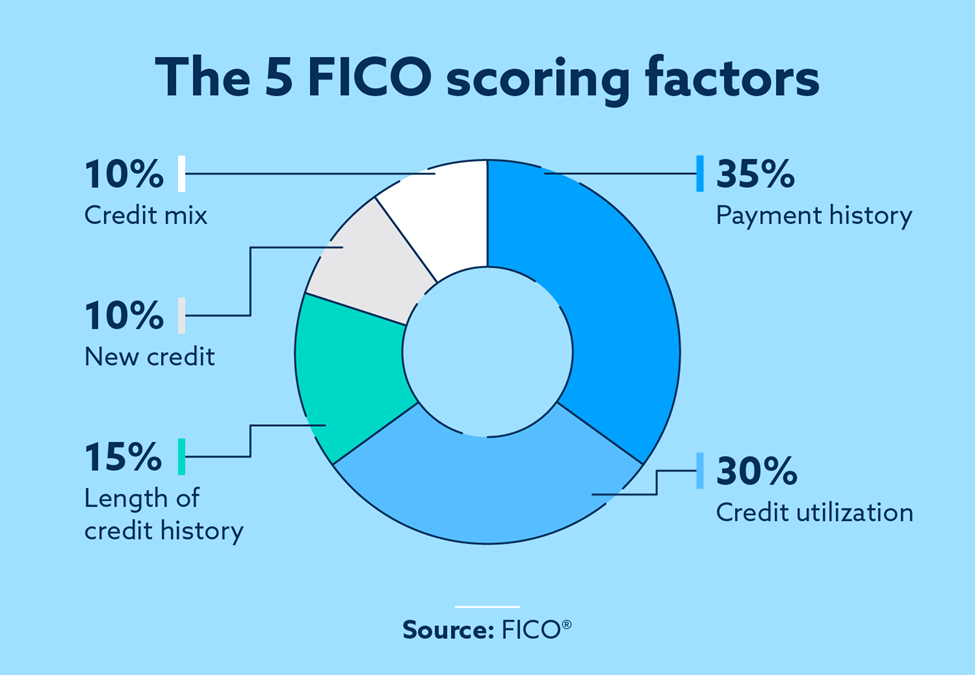

Your credit score can be damaged if you apply for too many credit card. A single inquiry will lower your score by five to 10 points, and multiple inquiries can lower your score double or even triple. Multiple inquiries can raise red flags with lenders. Multiple applications for credit cards can indicate that you may be overextending yourself.

Wait until you have an existing card before applying for another. To many applications can damage your credit score. Keep your old cards open. Lenders prefer to see a long credit history. It is better for your credit score if you have more than one account open than none.

It can be difficult to apply for too much credit cards at once. This not only hurts your credit score, but can also make you appear more risky to other credit card issuers. This will make you appear more at-risk and likely to default. Furthermore, multiple applications may lead to multiple hard inquiries on your credit report, which will negatively impact your score.

Avoid having more than two credit cards

While it may seem tempting to have a lot of credit cards, it is important to know that carrying more than two can be a problem for many people. In deciding how many credit card you should have, your financial situation, spending habits and credit history all play a part. You should keep an eye out for late payments and balances, and make sure to pay your monthly bill in full. Also, make sure to check your credit reports for late fees.

You must pay off your card's balance each month to avoid interest penalties that could damage your credit rating. You can also pay more than the minimum on your cards to improve your credit score. Credit utilization ratio, also known as total credit-to-debt ratio, is a key factor that can contribute to your score, so it's important to keep it below 30%.

Don't have too many secured credit cards

While secured credit cards are great for many reasons, they can also have some downsides. There are some that charge a high application fee and a large annual fees. To find the best interest rate and annual fee, it is important to compare them. In addition, a secured card may have a low credit limit, but you can increase it after you make consistent payments. It doesn't matter what card you choose; make sure that you pay your balance in full each monthly. This will ensure that your credit utilization rate is low and you don't pay interest.

Although secured credit cards can improve your credit score, you won't be able to get beyond a certain threshold if you rely solely on them. Because these cards have lower credit limits, it is difficult to keep your credit utilization low. Secured cards are often the only credit card you have when you build or establish your credit history.