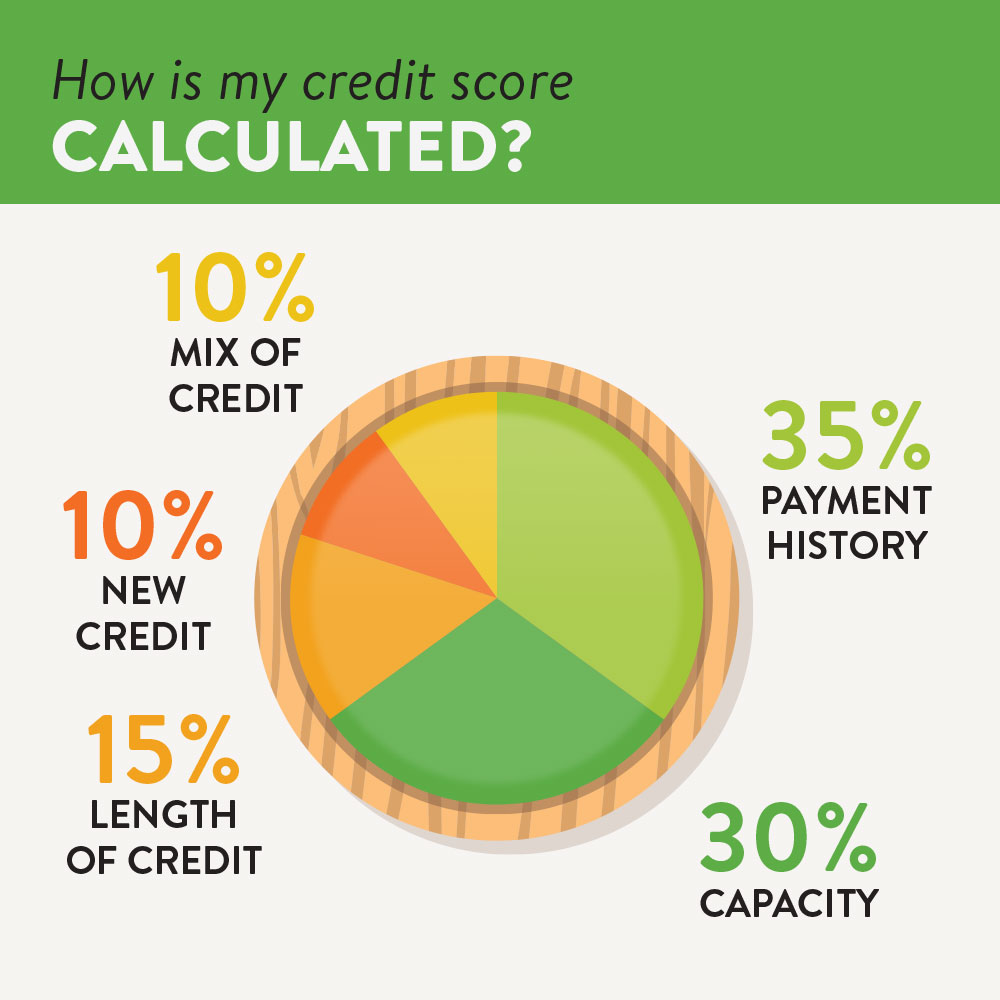

It is not clear why your credit score fluctuates. This happens because lenders use credit scores to determine your ability and risk to repay a loan. This is especially true if you need to apply for a home loan. This article will discuss three common reasons your credit score could be declining. These tips will help you get your score back up. For a better score, it is important to have a clean credit record.

How to pay off a loan

You might be curious as to why repaying a loan can impact your credit score. While debt-free is a great thing, there are many other factors that could affect your credit score. Lenders may see you as a risk if your credit card accounts are full. You can counter this by consolidating your credit, paying off any of your current lines of credit and increasing your total credit.

Applying to a new credit

Lenders perform credit checks and hard inquiries when you apply for new credit. Although your existing credit score is not affected, it can be affected by one inquiry that could result in a drop of three to seven percentage points. This decrease will fade in a matter of months. Keep your credit scores from being too low by not applying for new credit. A credit card is a good idea if you have great credit. Secured credit cards are available for those who don't have great credit.

Paying off medical debt

There are many people who wonder if paying off medical bills will affect their credit scores. Most people who receive medical bills go into credit. Your medical bills will not be listed on your credit report, provided that you pay them on time and during the grace period. Depending upon your individual situation, your provider might send the bill to a third person collection agency who will report it on credit bureaus. Although medical bills will not be visible on your credit report for six month, they will be reported by the credit bureaus starting July 1, 2020. Sometimes you might not get any notice from your doctor. In this case, you'll need to pay the debt within the grace period.

Use caution when applying for credit

Open new credit cards can decrease your credit score. Although these accounts have lower interest rates than others, they can still negatively impact your credit score. Instead, only apply for the credit cards you really need and pay them off on time every month. Your credit score will rise if you have multiple credit cards with different limits.

Hard inquiries should be avoided

You are reducing your chances of being approved for a loan if you make too many hard inquiries. This type inquiry shows the lender that you have taken on a lot of debt at once. Often, mortgages and auto loans are combined. Identity thieves can use your personal details to apply for new credit. This could eventually lead to missed payments.