You may have heard the terms "bad credit score", but you don't need to be. However, this article will help you better understand what these terms mean and how they can affect your life. A low credit score can impact your ability to apply for a loan and/or credit card. In this article, you'll learn about the impact that a bad credit score has on your life, as well as how debt consolidation can help you repair your score.

Get a subprime rating on credit

Even if your credit score has fallen below the prime level, there may be ways to improve it. Although your credit score might not be as high in certain cases, it can still affect you in other ways. A credit score less than 620 can be considered subprime. For example, if you're looking for a credit card, you may find that you need to put down a $300 deposit to get started. On-time payments to this card will eventually help you build your credit rating and allow you to obtain a greater credit limit.

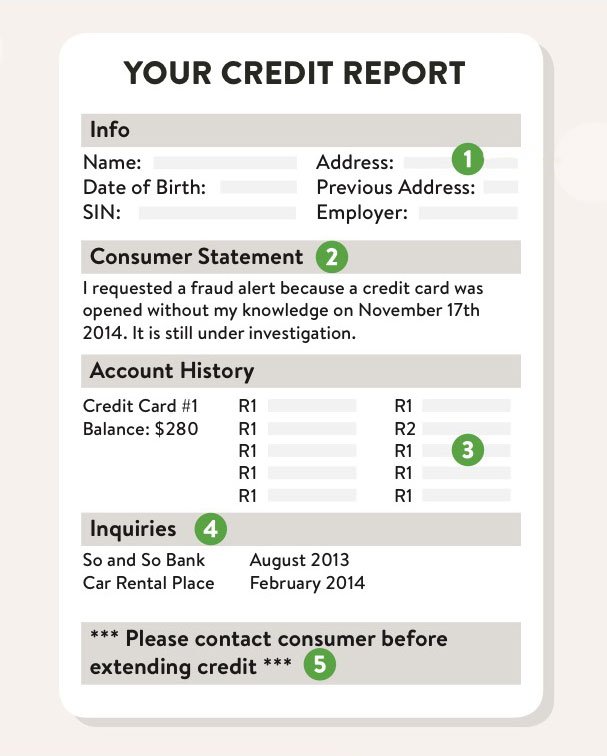

You may be anxious about how long the transition from subprime into prime credit will take. This question is dependent on your credit file. You can monitor your credit report free every week for a full year. If you have missed a payment or two, it will hurt your score for seven years. High credit card debt is another issue that you need to address. It can be difficult to repay the card completely if you have a high credit card balance.

There are other factors that could affect your credit score

Your credit score will be a major part of your financial and life. Your credit score can impact your ability to borrow money, your utility deposits, and even your chance of purchasing a house. Credit scoring companies have differing approaches, but they all agree that two factors are most important. These factors include payment history and credit utilization. Credit limit is the amount of credit actually used. In other words, if late payments are a regular occurrence, credit scores will decline.

Your credit score can also be affected based on how old your accounts are. The older your account is, the better. Credit scores can also be affected by accounts that have been closed but are still in good standing. Make sure to manage all your credit accounts and keep them active. Managing different types of accounts can also improve your mix of credit. Lenders appreciate that you have multiple accounts and can make multiple payments.

Low credit scores can have an impact on your ability and eligibility for loans or credit cards.

Bad credit could be the reason you aren't able to get a job. Your credit score might have dropped if your payments are late. Same goes for loans. If you have low credit, it might be difficult to obtain the best interest rates. Some services may be difficult for you, such as a mortgage or job. Bad credit can also hinder your ability find housing.

Credit score can be affected by many things, but a low credit score is the most difficult. Paying on time is the most important aspect. You can have your credit score negatively affected if you miss payments. Lenders want to see your payment history to determine if you can pay off their debt. 90% of the best lenders consider your payment history when determining your FICO(r), or credit score. It accounts for 35%.

Fixing a low credit score with debt consolidation

As a way of paying off debts, debt consolidation is one of your best options to fix low credit scores. Debt consolidation allows you to make one monthly payment and lower your interest rate, and you can even lower your monthly payments with the help of autopay. But beware of your credit score! Low credit scores may make it more difficult to qualify and pay for certain debt consolidation options. Prior to applying for a consolidation mortgage, it is important that you address any spending problems.

Consolidating multiple debts can simplify your monthly payments. You can make your monthly payments easier by only making one payment. This can also help you avoid missing payments which could lower your credit score. However, debt consolidation is only beneficial if it has a lower interest rate than the credit card debt you are carrying. If you are paying 16 percent to 20% APR on your credit card debt, debt consolidation can help you save hundreds each month.