Online credit cards are available with different features and forms. Before you apply for one, it is essential to learn all about its benefits, the process of application, interest rates, and possible refund options. Then, you can make a decision based on the information provided. It can be hard to find the best online card for you. But here are some guidelines that will make it easier.

Benefits

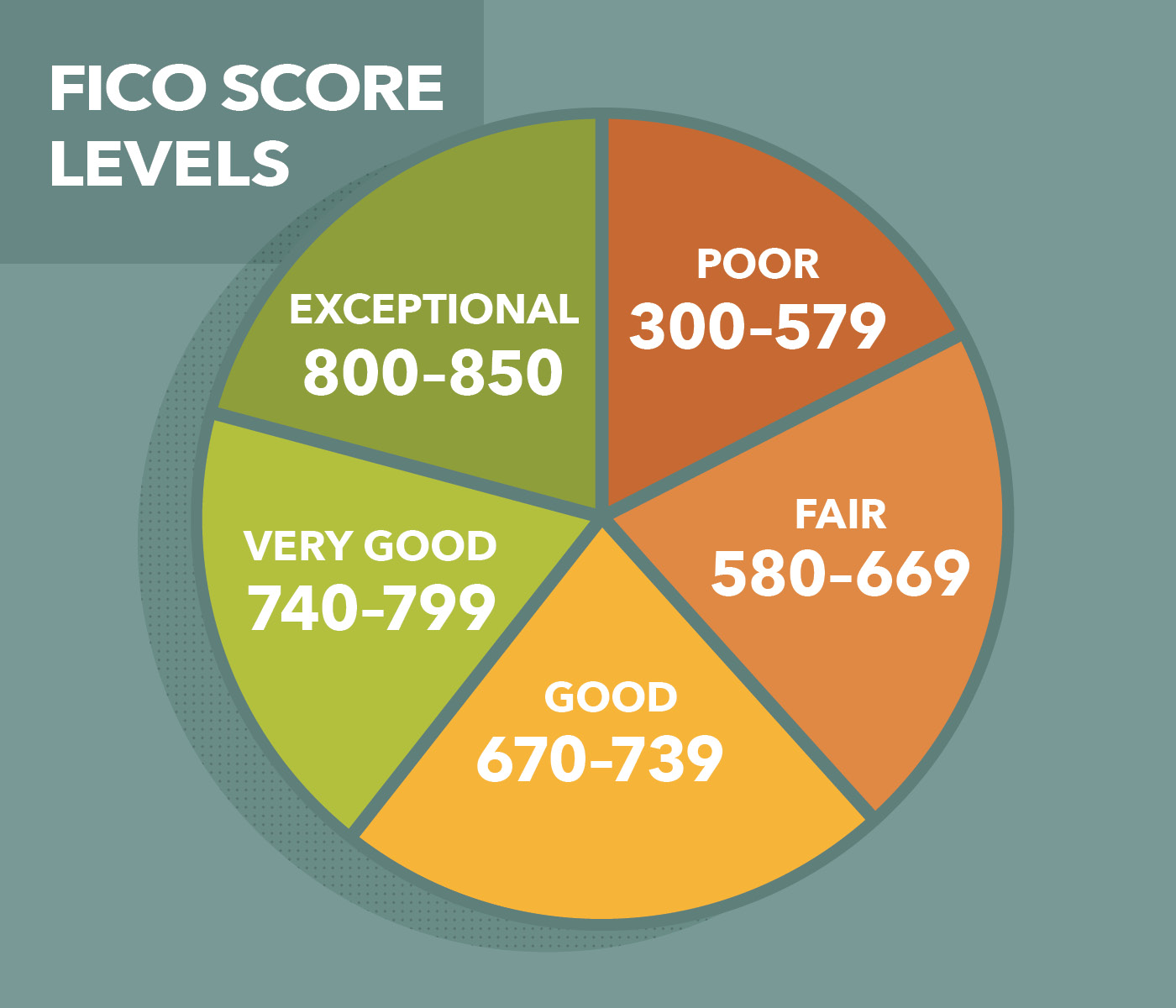

They are convenient for making purchases and offer many benefits to consumers. Credit cards are a great way to build credit and earn better interest rates. These cards also come with rewards and points that can be used to purchase. Many credit card companies will give you a credit score for free. These scores do not update as often as WalletHub’s credit score service. Additionally, they do not provide personalized credit advice.

A lot of credit cards offer bonus points to spend, which can be used to purchase merchandise, travel credits, or statement credits. Some cards even offer special gifts when you spend certain amounts. In addition, many credit cards offer introductory bonuses for opening an account. These bonuses can help save you money over time.

Apply process

An online application for a credit card is very different to an offline application. To start the application process, a customer must provide his Street address. The system will then look up the Customer’s delivery code (which should read B). This field must be set in order to initiate the application process.

Most applicants will need to give their name and address, social security number, income and bank account information. Some issuers may require additional information such as a credit score. This is for two reasons. It helps to verify your identity as well as ensure that you have the financial ability to pay the monthly payments.

Rates of interest

One way to avoid paying interest on purchases made on your credit cards is to pay the full balance every month. Your credit score may allow you to negotiate for a lower Interest Rate. You may be able to pay no interest at all in some cases. This is an option if you are unable to pay any interest.

The Federal Reserve recently increased the rates of most credit cards. While this is good news to consumers, it can also disappoint many. Fortunately, most credit card issuers are not required to pass on increases to new applicants. However, historically, the increase in federal interest rates has translated into dramatic increases in APRs for new credit cards. The Fed has announced six rate increases, including two one-quarter-point increase and four three percent increases. Most credit cards have seen similar increases in their APRs, and some are even advertising APRs that are three points higher than they were last spring.

Refund options

Many credit card issuers provide online portals that allow consumers to request a refund. Although refunds are typically applied to your account balance, they can also be issued as checks. This is useful if you have an upcoming invoice or a balance that has been negative for a few months.

Refunds can take several weeks to be processed, but it can take as much as six months. The time it takes for a refund to appear on your account depends on how long the merchant takes to respond to your request.

Card issuers

Banks and other financial institutions are credit card issuers. They provide consumers with the ability to purchase credit cards. They offer rewards and report payment history to credit bureaus. The issuer decides credit limits and charges interest rates. They also benefit from their relationships with consumers and their payments.

The fees card issuers charge vary depending upon the card used and the amount of transactions. The typical fees are between one and three percent of the transaction amount. These fees are split with payment processing networks. These fees are charged to credit card issuers to make money, but they are often negligible compared to rewards programs.