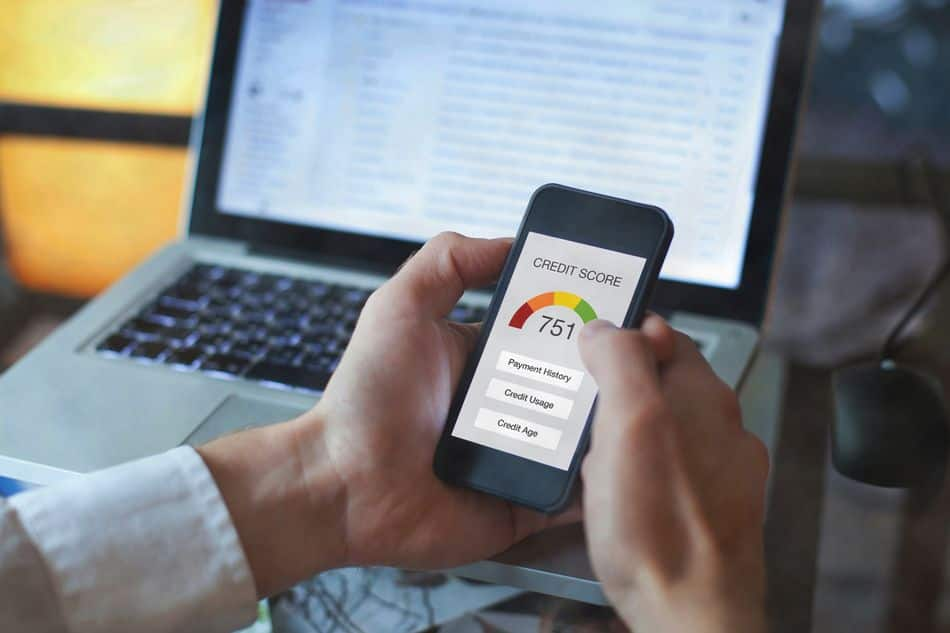

The age of each credit card is a key factor in determining the length of your credit history. Let's assume you have three creditcards: Card one is three years old; Card two is five years old; and Card three is one year. In this instance, your credit history is three years.

15 points

The length of your credit history can have a big impact on your credit score. Credit scoring models factor in how old your oldest account is when determining your score. Check out your credit score to see how old you oldest account is. This information could help you improve the credit score. There are several things you can do in order to increase your credit score.

128 points

You can increase your credit score by paying more on your credit cards than the minimum and by reducing the total balance on all of your credit cards. You should also set your own credit limit to avoid going over it. Lenders will be looking for evidence of credit management that has been consistent over time. The length of credit history is worth around 128 points. It shows when your first accounts were opened and when you made the last payment.

A credit score of 128 and below will not allow you to obtain a loan, credit card or mortgage. But there are ways you can improve your credit score. Although it can take several years to get your credit score up to a high standard, it is possible.

Age

Your credit score is affected by the age of your credit history. Your score will increase if you have more than one credit account. Your score can be affected by closing credit accounts. Luckily, there are ways to minimize the impact of closing a credit account.

The age of your credit history is calculated as the average number of years that you have had the same type of accounts. If you have three credit card accounts, your average age would be three years. If you have five or more cards, your credit score would be seven.

Asking hard

One of the best ways to manage your credit score is to be diligent and monitor it regularly. Many banks offer tools that can be used to check your credit score and credit reports for free. Experian for instance offers free access and reporting to your FICO(r). It is important to monitor your credit reports on a regular basis in order to minimize the impact from hard inquiries.

Lenders will request a copy your credit report when you apply for a loan. This is known as a hard inquiry, and it will lower your credit score by a few points. After one year, these inquiries will no longer be added to your credit score. These inquiries will also disappear after two years.

Average age for account

When looking at your credit history, the average age of your accounts is an important factor to consider. A longer history will improve your credit score. However, a shorter one will result in a decrease. Your credit history can be affected by many factors, such as your age and demographics. Credit accounts that are open and current can help increase credit history's average age.

If you are applying for a loan and/or a credit card, a long credit record will be of benefit. Your credit history will be less old if you open new accounts. Do not open new credit accounts unless you have a clear goal.