A 18-year-old credit card is a great tool for young adults with poor credit histories. There are several credit card products available for young adults, so there are several options to consider. This article will explain the Capital One Venture XRewards Credit Card, Petal 2and Chase Freedom Unlimited.

Capital One Venture X Credit Card

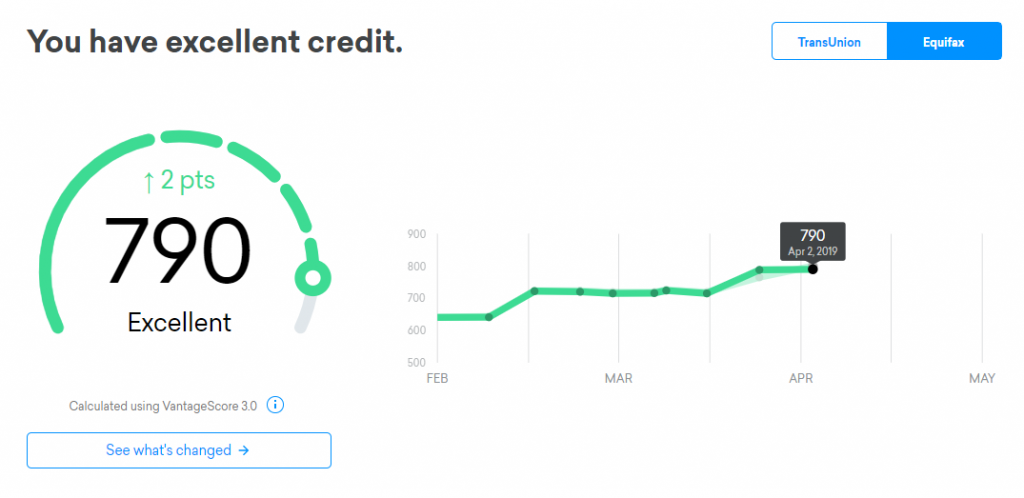

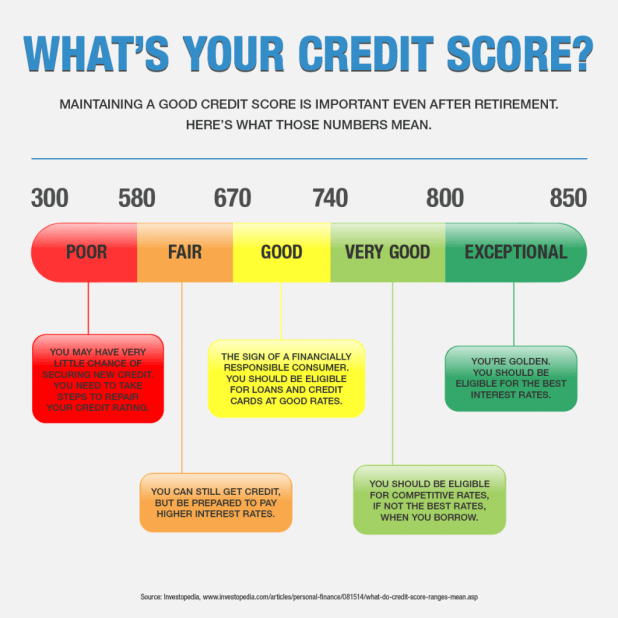

Check the eligibility requirements for credit cards before you apply. This type of credit card requires applicants to have a credit score over 740. It is possible to be approved even if your credit score is between 700 and 740. This credit card offers many great benefits.

The first step in obtaining a credit score from all three credit agencies is to request one. You will need to get rid of any credit freezes on your credit reports before you apply. This is a common practice for many credit cards companies. Venture X rewards creditcard has some distinctive features.

As the name suggests, Capital One Venture X rewards credit card offers two times the amount of Capital One miles on eligible purchases. The credit card comes with a $95 annual fee, and a Capital One Travel Portal. It also offers two free lounge visits per year, as well as the opportunity to earn 75,000 bonus miles when spending $4,000 within the first three months.

Chase Freedom Unlimited

The Chase Freedom Unlimited 18-year old credit card offers a modest sign up bonus, but lower rewards, than premium Chase credit cards. Nevertheless, if you're 18 years old and have good to excellent credit, you might be able to get approved. The minimum FICO credit score required to get this card is 670.

The Chase Freedom Unlimited 18 years old credit card is a good option for those who want to earn high cash back without paying high annual fees. The card earns 1.5% cashback on all purchases, and 5% on Chase dining and travel purchases. Other benefits include no annual fee and the ability to keep all of your rewards.

Chase Freedom Unlimited, an 18-year-old credit-card, has no annual fee. It also offers a low intro rate. After the promotional period, APR increases to high rates. You will have to pay a foreign transaction charge of 3%. There is no annual fee. This card is ideal for anyone who plans to travel abroad. You can also get trip cancellation insurance or emergency assistance.

Petal 2

Petal 2 credit cards are a great option for anyone 18 years old looking for a card. This card provides a high credit limit to those with poor credit. However, the APR is high compared to the average for credit building cards. It is important to remember that missed payments may negatively impact your preapproval decision.

Petal Rewards and Petal Offers are two types of cashback offered by the Petal 2 credit cards. Petal Offers allows you to earn cash back on select purchases. This bonus program is for customers who pay on time. You may earn 2% to 10% cash back at selected merchants, depending on how much you spend. Cash back is automatically deposited into your Cash Back Wallet and can be redeemed for statement credits, cash in a check, or direct deposit into your bank account.

The Petal 2 Visa "Cash back, No Fees", Visa credit card may be an option for those with poor credit. This card offers cash back on eligible purchases and offers a high credit limit up to $10,000. Petal 2 has many advantages, including an app that helps you track your spending and improves the credit score. This mobile app allows you to see your credit score, account balances, as well as payment due dates and rewards. You can also track your spending habits to improve your credit score.