It is crucial to have a high credit score for several reasons. First, good credit can make you seem less risky to others than people with bad credit or unstable credit histories. Second, your credit score can impact everything in your life. It can influence your access to certain services as well your ability for housing. Third, your credit can even affect your livelihood.

Benefits of having good credit

Good credit is essential to be eligible for many benefits associated with credit cards. High credit scores can lead to lower interest rates and more rewards. Credit scores are also considered by insurance companies when determining the premiums for your policy. A high score means that you pose less risk to an insurance company.

Good credit can be used for many things in life, including purchasing a new home or car. You may also be eligible for lower interest rates and easier employment eligibility. Your credit rating can also make renting or leasing an apartment easier. You may even be able to qualify for a utility account without a security deposit.

Costs of having bad credit

Bad credit may affect your ability of getting loans and credit cards. A loan with poor credit rating will cost you more. Lenders use credit scores to assess risk and determine whether you're likely to pay back your debt. They view borrowers with lower credit scores as higher risk because they're more likely to default or miss payments. While the higher interest rate can offset this risk, it also reduces your cash flow.

Not only will you have to pay more interest on your loans but also higher deposit fees in order to obtain a credit score card. You may have to pay higher deposits from some utilities than others. You may not be able to access premium plans and services. You can lower the costs of bad credit by learning how to improve your credit and stay on top of your credit score.

A credit card with a low interest rate

Credit-card accounts with low interest rates may be available to those with good credit. These cards are great for those who want to have high purchasing power while not paying high interest rates. You should contact the creditor to ask for a lower interest rate, if you feel your current rate is too high.

The best way to find a low interest card is to compare offers from different lenders. Begin by reaching out to your bank/credit union to request a list containing credit card offers. Compare the APR and benefits of each offer. You should also pay attention to foreign transaction fees.

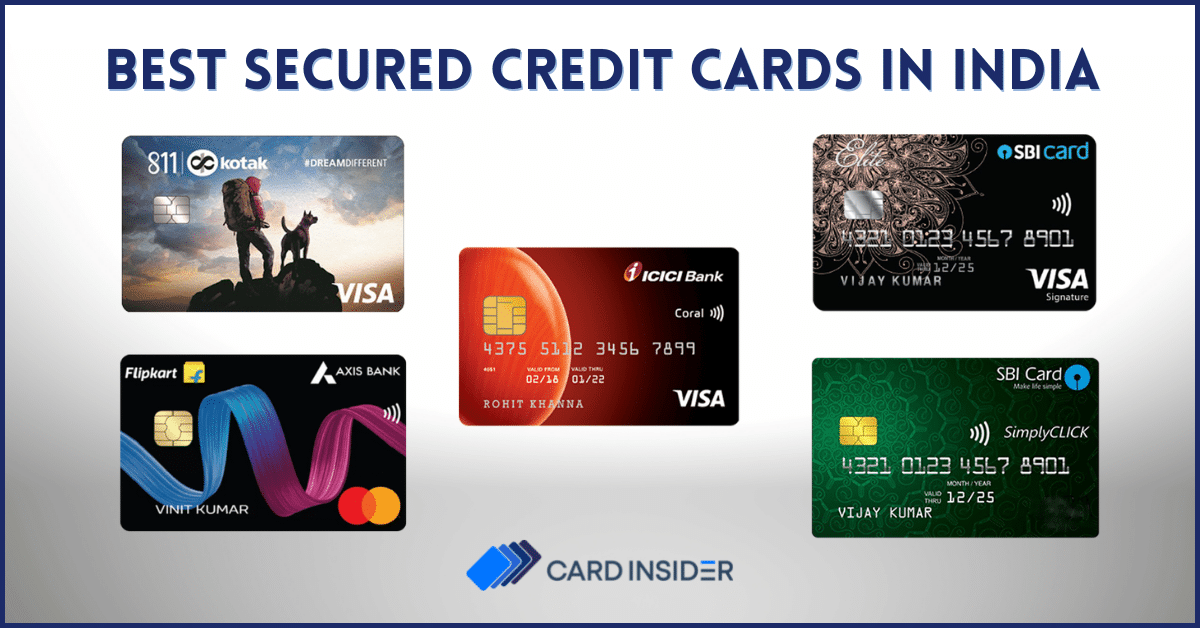

Getting a store credit card with no security deposit

A store credit card comes with no security deposit and offers many benefits. The card can be used for purchases, and you don't need to deposit a lot of cash. You can also transfer the card to another credit card or to a bank account. But you will have to pay a service charge and transfer fee. Additionally, if you don't have the best credit, you might consider saving up to make a large purchase ahead of time.

Low credit score customers can get store credit cards with special features. These cards allow you cash deposits instead of security deposits and offer extra interest. Your credit score will improve when you pay on time and repay the extra interest. A regular credit card is also possible once you have improved your credit score. Experts recommend that you avoid store cards with poor terms. Instead, opt for a card offering easy terms that allow you to enjoy shopping.