Many people wonder if having multiple credit cards helps their score. The good news is that having more than one credit card can actually benefit your score. This allows you to receive more benefits and greater flexibility when using your credit. In addition, it can help you manage your debts. Additionally, it is advantageous to have several credit cards when you shop online. This is because you can use separate cards for tracking your spending and preventing fraud.

Multiple credit cards can offer many benefits

Multiple credit cards can increase your credit limit and decrease your credit utilization rate. Different cards can offer you different deals and rewards for different types of purchases. You may be interested in a cashback card if you are a frequent shopper at supermarkets. You might also want to consider a travel reward card if your travels are frequent, whether for business or leisure. It is also a good idea to have a backup card.

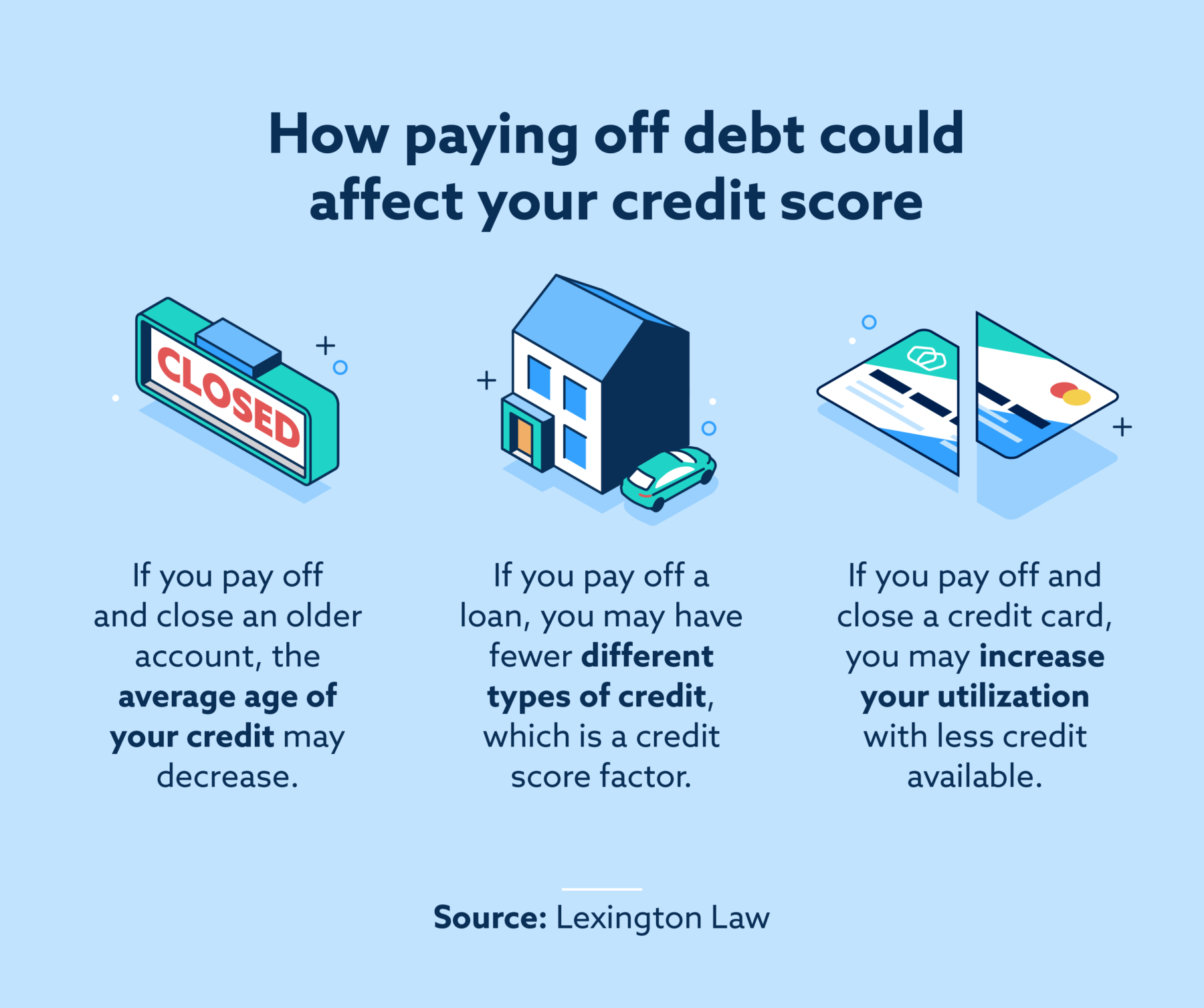

One advantage to having multiple credit cards, is that you can transfer your balances from one card to another. This will decrease your credit utilization rate, and improve your score. But, you should be aware of any annual fees that may apply.

There are some downsides to multiple credit cards

While you may think that having multiple credit cards is a good idea, it can have negative effects on your credit score. If you have several credit cards, it may take longer for your credit score and to rise, particularly if it isn't. You may have difficulty getting approval for new cards if you have multiple credit cards. Your score can rise if your bills are paid on time.

Multiple credit cards are a smart idea, if you have good financial habits. This is because you can get multiple benefits. If you are confident managing multiple cards, then you shouldn't use them. You should only use one card if you aren't confident with managing them all.

Credit score can be negatively affected by having too many cards

It is essential to limit the number of credit cards you have. This will help you improve your credit score. To issuers, too many credit accounts will make your profile look risky. This can make you more likely to get into debt and have to go through hard credit checks. This will negatively impact your credit score. You may also be more likely to spend, which can lead to increased debt and missed payments.

The negative impact that having too many credit accounts has on your credit rating and credit score is the first. A few points can be lost if you have too many credit cards. But it isn't the only thing that hurts your score. The number of credit cards you hold is not the only factor that can affect your score. It is important to use your cards responsibly while making timely payments.

The complexity of managing multiple credit cards can also be a problem. It can be hard to manage multiple cards, especially if they have different annual fees or interest rates. Many premium cards have an annual membership fee. Some will offer teaser rate introductory offers. You should also keep track of all credit card terms. Too many credit cards makes it appear that you are a riskier borrower to lenders.