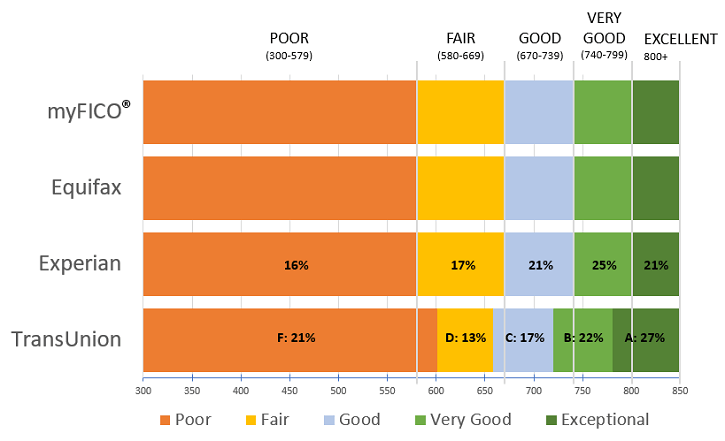

TransUnion, Equifax, or Experian can all give you a credit score. Each bureau will offer a different score but they all use the exact same model. TransUnion's credit scores ranges are based off the VantageScore3.0 model, which was created by three credit agencies. Credit Karma will not sell your personal information to advertisers. Instead, it will use your information to recommend financial products based on your credit score.

Understanding credit score ranges

It is important to be familiar with credit scores before you apply for a loan. These help you determine the amount of money a lender will lend and the terms they are willing offer. Credit scores are based on different criteria from different credit scoring models. For example, your VantageScore 3.0 score may be good, while your FICO score may be fair.

Your credit score is three-digit number that identifies you borrowing ability. This will affect whether you are eligible for a loan or credit card. Your credit score is a number that tells potential lenders how likely and able you are to pay off your debts. It is essential to know your credit score range, and the factors that influence it. This will allow you to assess your credit needs and improve credit scores.

The credit score is an important factor in getting a mortgage. While mortgage lenders look at many factors such income, employment history and debt to income ratio, the most important indicator is your credit score. To get a good score, you need to monitor your credit score regularly. It can help you spot problems quickly by keeping track. A sudden drop of your credit score could indicate identity fraud or an error on the credit report.

To compare your options, you can use credit karma

Credit scores provided by Credit Karma are often used for loan and credit card applications. These scores can be misleading. Many people have seen their scores drop, even though they are actually higher than their actual. They then apply for loans or credit cards thinking they have great credit. However, their actual credit scores are actually very low.

Credit Karma utilizes the VantageScore credit rating model. It also contains data from Equifax and TransUnion. It can be beneficial to view multiple scores but you don't need to choose from more than one. Credit scores vary between reporting bureaus, and can be very different depending on the model.

Keeping a healthy credit score

Your credit score is a number of three-digit numbers that can affect your ability to get credit cards or loans. Your credit score can tell potential lenders whether you are likely to pay your debts on time. Knowing how your credit score ranges and how to improve it will help you make wise financial decisions.

Regularly reviewing your credit score is essential to maintain a good score. This is especially important when you apply to a loan or credit card. It is possible to damage your credit score with one incorrect entry. Credit Karma, a free credit score monitoring tool that you can use to monitor your credit, will help you keep track of your credit and spot errors before they affect your credit score. You will need to know what your credit scores are if you want a mortgage or a home purchase.

Maintaining a good credit score will help you get approved for the best rates and terms. Lenders can deny applications if you aren't able to pay off your debts on time each month. You can avoid being denied by lenders by monitoring your credit scores and reporting on a regular basis.