A long track record of timely payments is one of the best ways of improving credit. Late payments will be reported by the credit bureaus if your payment is more than 30 days late. It is best to make your credit card payments on-time or less than a day late. Setting up autopay for your credit cards is another way to avoid missing payments. Autopay allows for you to easily make your payments.

It is important to pay bills on time

Your credit score is affected by almost every aspect of your daily life. Your payment history is the basis of over a third your credit score. It is crucial that you pay all your bills on time. Even missing one payment could result in late fees or a negative mark on your credit report. Your credit report will likely include information about your loans and credit card accounts. Some services, like utilities or cell phones, will also report your payment history. It does not matter why you are late paying, it is crucial that you pay your bills in full.

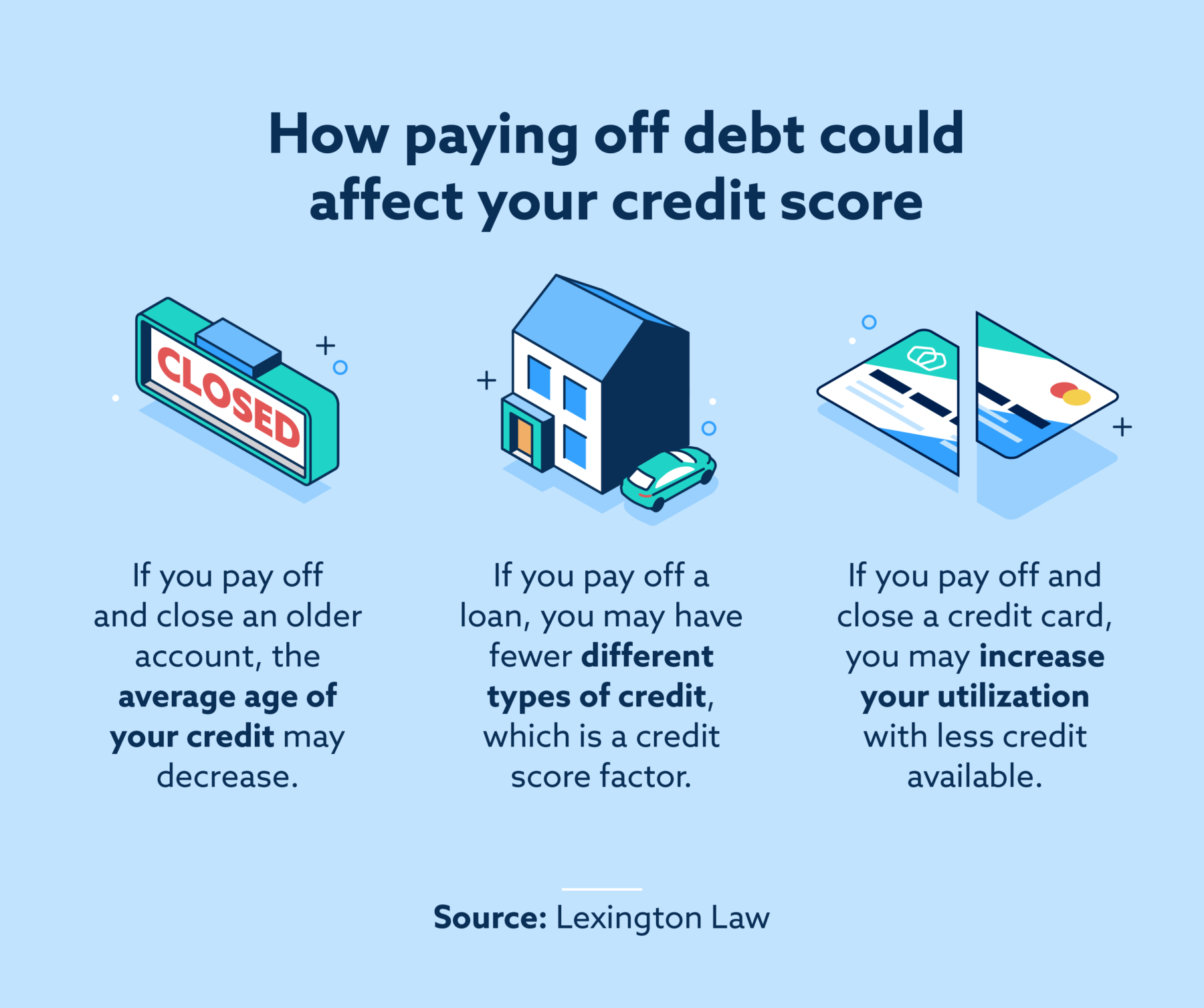

Eliminating all outstanding debt is the best method to improve your credit score. Paying off debt can raise your score, but having too many open accounts can lower your credit score. High-interest debt can be eliminated by paying off your credit cards first. It will take time for negative items to disappear, even if they are the same amount as before. It is better to pay off your highest-interest balances first and make minimum payments on all other accounts. It is important to not open any new credit cards in order to improve your credit score.

Responsible use of a credit card

It is essential to fully understand your customer agreement before you use a creditcard responsibly. Although credit card companies may provide information about their credit cards programs on their websites, details are only available in the agreement. Paying your credit card monthly in full can help you avoid excessive spending. You'll be able to improve your credit score and build positive credit histories.

Credit cards can be an excellent tool for improving your financial status if they are used responsibly. They can be used to pay for travel or dining out. You can earn cashback or rewards for purchases. To avoid interest penalties, make sure you pay off your entire balance each month. Avoid carrying a balance if you can. When you use your credit cards for small purchases, ensure that you pay the full amount each month.

Paying down debt

There are many things you can do to improve your credit score. The best thing is to pay your debt. The good news is that your credit score won't be affected if you pay off your debt until the lender reports the payment. It is always best to get rid of your debt as soon possible. It is essential to first establish a budget. Then, prioritize the payments. You must also reduce your spending in order to make more money for the payments.

If you don't have much extra cash on hand, you may want to pay off the smallest debt first. This will not only take longer, but it will also help you save money. Another strategy is to make the minimum payment on all your debts. Then, funnel any extra money to an emergency savings account. This way you can cover unexpected expenses and not use your credit card. If you can't make your minimum payments, set aside an extra $1,000 in savings instead.

A small loan can be taken to help build credit

A small loan can be used to build credit. These loans are typically lower in interest than larger loans. Borrowing money with smaller payments is also better for your finances than spending it out of your pocket. Avoid paying interest which could damage your credit score. This type of loan can be used to build credit or even improve your credit score. However, you should take care to choose a loan that is affordable.

A credit-builder loan can cost anywhere from $300 to $1,000. It has two main benefits: it can help you improve your credit score, and show lenders that you are capable of managing your money. You can also use the money as a nest-egg to save for a rainy day. Different credit builder loans work in different ways. Some loans are offered free by a partner bank, but others have a monthly fee or interest. Credit builder loans are usually not offered by large banks but by specialist lenders.