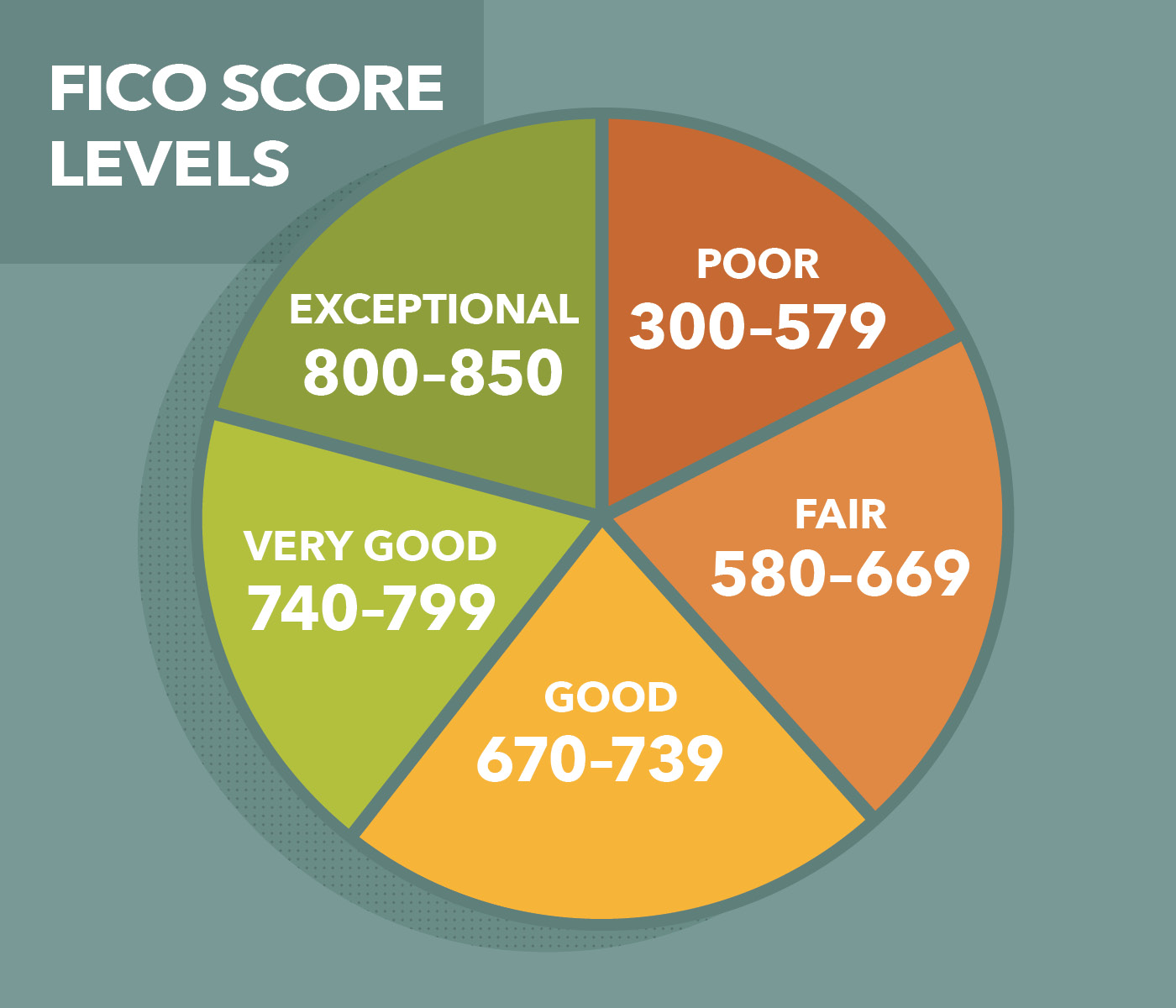

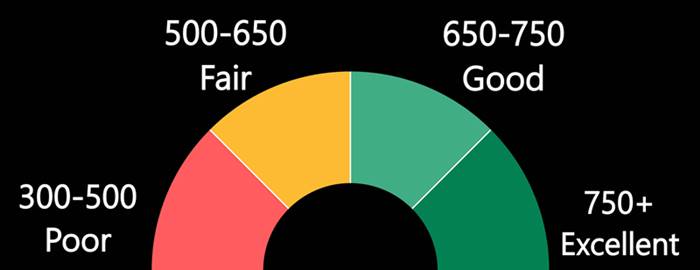

As long as you fulfill certain requirements, you can build credit at any age. FICO and VantageScore are the two main credit scoring agencies. There is no age limit. This will depend on how high your credit score is and what the minimum score is. Credit scores don't start at zero. However, they can be calculated as a range starting at 300 (the lowest possible score), and moving up depending on the information in credit files.

Your child can get credit through an authorized user status

The majority of major credit card issuers allow children as authorized users to their accounts. However, they must be at the least 13 years. Adding a child to an account as an authorized user helps your child build their credit history and may improve rewards on the account. This can help your child build up credit as they grow up, which will make it easier for them to access money as they get older.

One of the most effective ways to boost your child's credit and to build a positive credit rating is to add your child as an authorized credit card user. This will improve their credit history because they will have a history of making on time payments. How well you manage this account will impact your child's credit score. Your child's credit score will be affected if you make late payments or have a large balance.

Secured credit cards are a good way to build credit

A secured creditcard can be a great way to establish credit if your credit score is not yet high. These cards don't need an initial deposit. You can also report your transactions to the credit bureaus on a regular basis. These cards are great for building credit by teaching responsible spending habits. Secured Cards are for those who don't have the credit skills to get a card.

Research is important before you sign up for a secured bank card. You should be aware that these cards could have hidden charges and high fees. Secured cards are best if they don't charge an annual fee, offer purchase protection, and track your credit score. Consider a secured credit card that offers cash back or rewards.

Another advantage of a secured card is that it is much easier to qualify for one. This card reports your payments to all three credit agencies, which improves your score. Your score will be affected if you don't pay your bills in time. You should also keep your credit balances low, under 30% CUR. If you follow these tips, you should see an increase in your credit score in a few months.

Co-signing is an insecure way to get credit.

Both the cosigner and borrower are at risk by cosigning. This involves giving your credit card to someone else and is not recommended by anyone under 21. However, most young adults do this in order to obtain a student loan. Their parents may cosign for their support.

The practice of co-signing can be dangerous and could cause you to lose your credit history or relationship. The lender will sell a cosigner's credit card to a debt collection agent if they are unable to pay their dues. In this case, the collector will go after the primary borrower and not the cosigner. The co-signer could file bankruptcy which can impact their payments obligations.

You can always add another authorized user to a credit-card account if you're unsure about whether cosigning is a good idea. Although authorized users can help establish credit history and avoid the risk of co-signing with others, it is important to choose carefully who your authorized user will be. Be sure that they are able and able to pay any charges.