Credit Sesame offers a free and easy way to manage your personal financial affairs. It provides identity theft insurance as well as free credit scores. TechCrunch disrupt 2010 launched the startup in private beta. The company now monitors almost $35 million in loans. The company's goal is to help consumers make more informed financial decisions and get better credit scores.

Credit Sesame is a free personal financial management tool

Credit Sesame makes it easy to manage your debts and credit score. This free tool compares loans from different financial institutions and looks at factors such as interest rates and loan terms. It can help to keep your finances in check and make the most of credit scores.

The tool analyses your credit history and debt load daily. This tool will show you how to save money. You can also see which debts you have and suggest ways to lower your payments. Members receive a free credit score evaluation and a home value estimate. They can also access free identity theft prevention. Members can also contact a live agent to report identity theft.

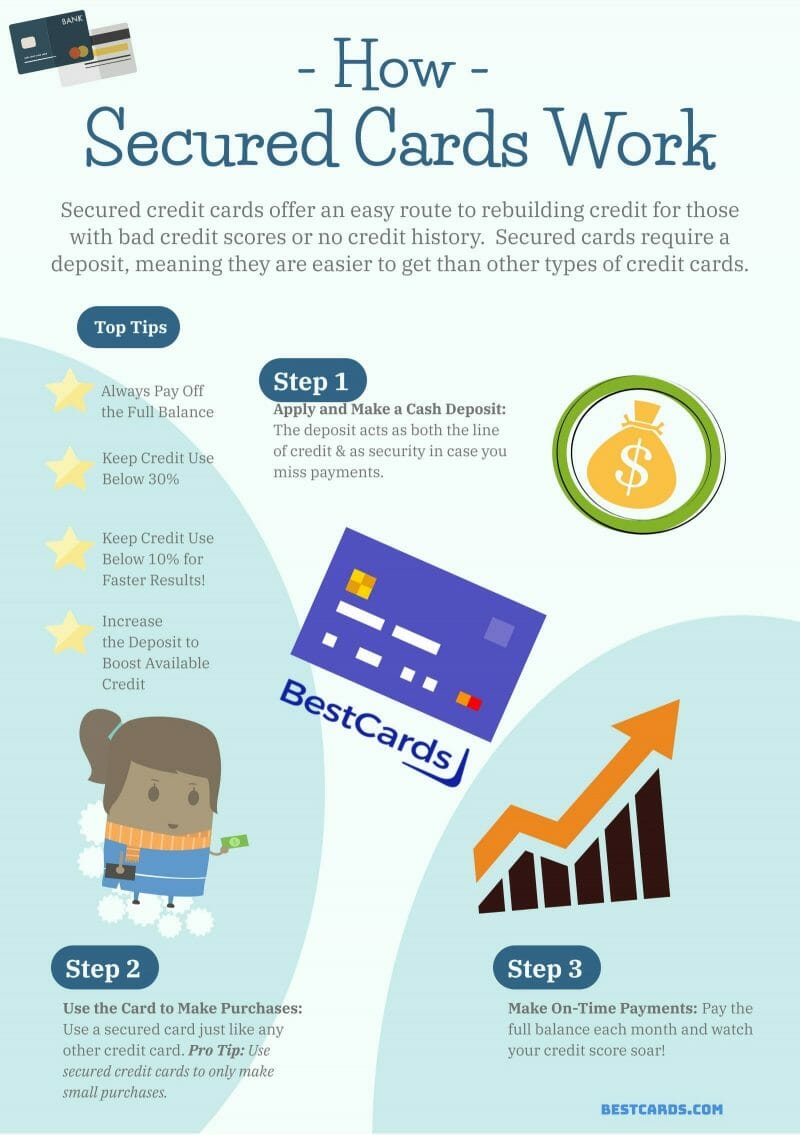

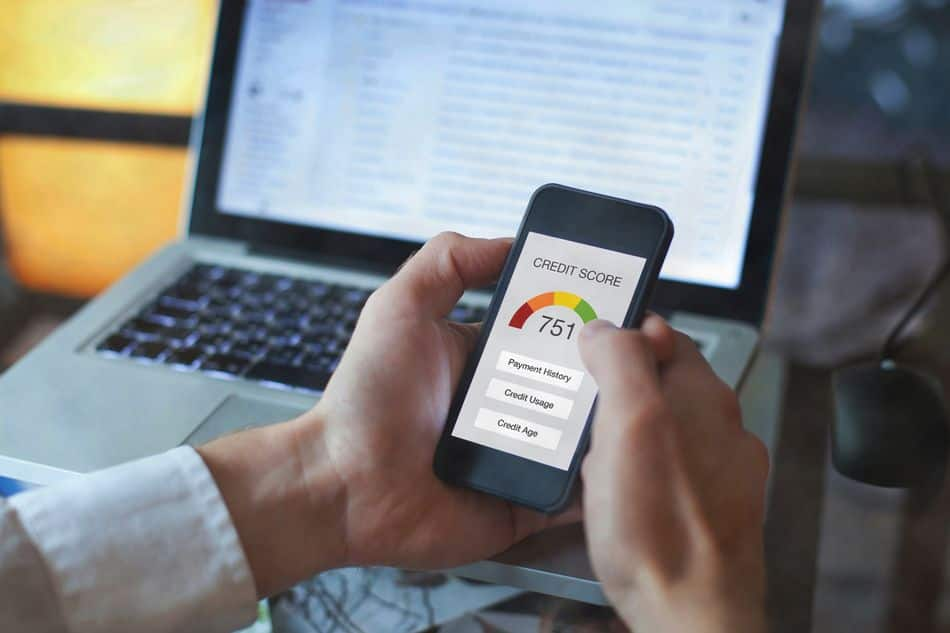

This service will allow you to assess your credit score monthly and provide you with a copy of your TransUnion credit reports for free. It also rates your credit standing on a Vantage scale. Your credit score is an indicator of your financial status. The tool provides tips and suggestions on how to improve it. The tool also provides a free credit report card, which identifies any credit-related problems and suggests steps to fix them.

It offers free credit scores

Credit Sesame provides a free service that will give you your credit score and home value. It also includes other statistics that lenders may be interested in. It's updated every month and can be accessed on both mobile and desktop devices. It gathers data from TransUnion and dissects it to show you the elements that contribute to your score.

Credit Sesame's credit report card uses TransUnion data to calculate your credit score. It offers tips and tricks to improve your score based upon your particular situation. You can also opt for a premium plan which gives you access the credit reports of all three major bureaus, as well your VantageScore.

Credit Sesame also reviews your credit report every day, taking into account both your goals as well as your finances. It may recommend lower debt payments in order to make it easier to fund your financial goals. The service also provides members with a free report that details their credit score and debt. If they are victims of identity theft, they will be able to view their home's value and can get a $1,000,000 Identity Theft Protection Plan.

It offers free identity theft insurance

Credit Sesame may be an option if your concern is identity theft. They offer a free identity protection service and automatically cover you up to $50,000 in identity theft insurance. If you've been victim to identity theft the company can provide access to certified identity recovery specialists to assist with your identity repair.

Credit Sesame is a credit tracking service, but it also offers free identity protection insurance to its premium subscribers. If you've been the victim or identity theft, this premium service will provide identity protection. You can also get customized plans to pay off loans and credit cards, as well as a variety of other services.

The service will allow you to see exactly how lenders view credit. This allows you to make better financial decisions. This also lets you see which financial products work best for you. Credit Sesame, for example, will tell you how much your credit will rise once you have been approved for a loan.