A combined credit is a score that's derived from the combination of your VantageScore® and FICO scores. It does not reflect your total credit score. Mortgage lenders may also consider these factors. However, you should not assume that combined credit reports will generate a similar score. Each credit bureau uses its own scoring system.

VantageScore

VantageScore credit scores are a combined score of information from the three credit bureaus regarding your credit and payments. It also considers several factors, including your payment history, available credit, and age of credit history. While the VantageScore model takes all these factors into account, the FICO credit score only takes into account one of them.

Recent credit activity can affect your VantageScore combined credit score, including the opening of new accounts or credit inquiries. These recent actions are a reflection of your current financial health. Lenders are interested in seeing that you only take out credit when you absolutely need it. This means that you will be able to improve your credit score by paying your debts on time.

FICO

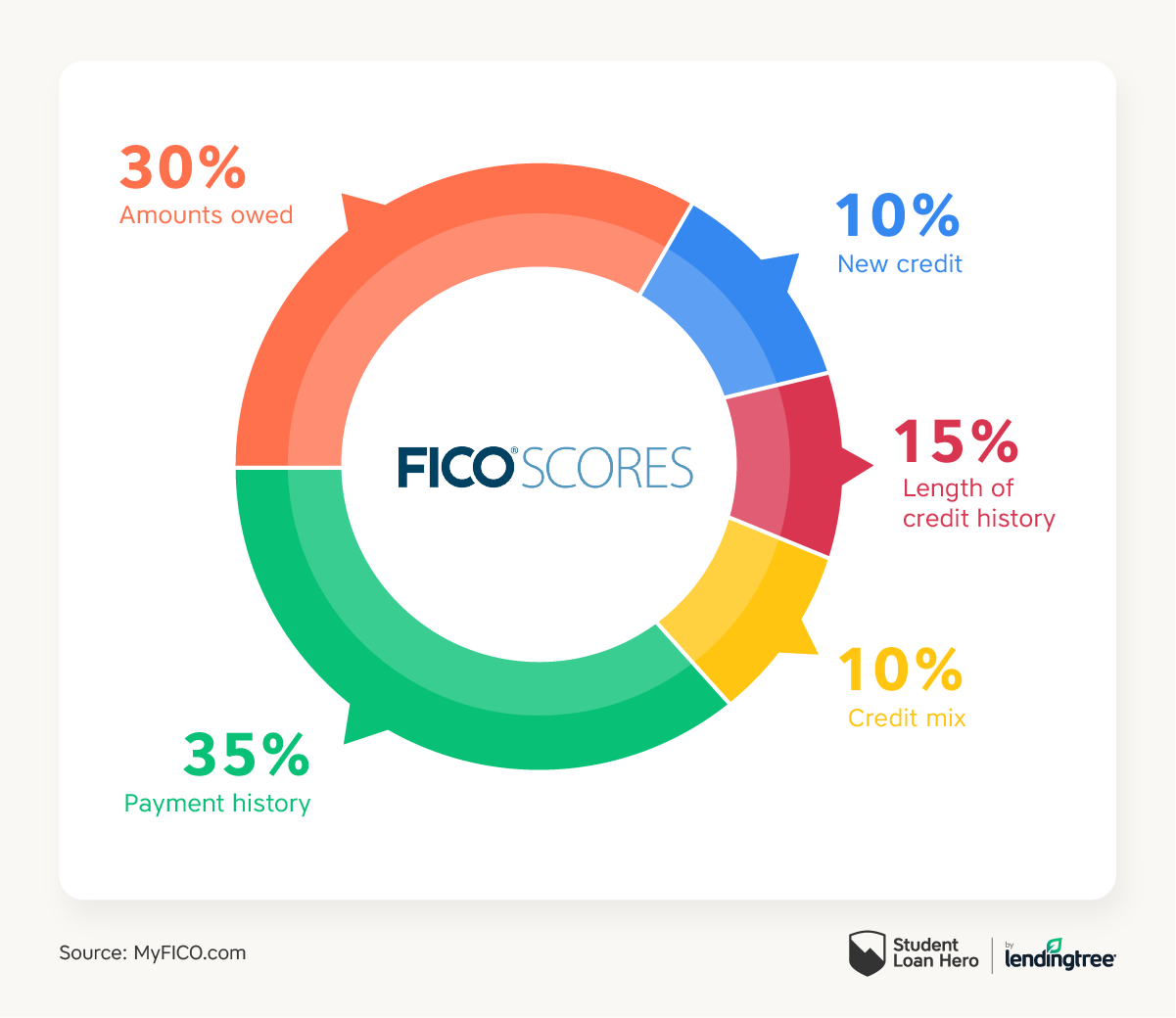

Homeowners looking for a mortgage should use the FICO combined score credit score. It helps you determine if you are able to afford the mortgage. The score is calculated based upon five factors that may vary depending on your credit history. For example, a person who has a short credit history may have a score that is higher than someone with more experience. Your credit score changes as new information is sent to credit bureaus.

Lenders also take into account the length and quality of your credit histories. It helps them gain a more detailed view of your credit history. This can translate into a higher FICO combined rating. It is a measure of your ability to pay on time and keep your credit utilization rate low. Your credit history is affected by many factors. These include the age of your oldest and most recent accounts, the average age and the length of time that each account has been open or closed.

VantageScore(r)

VantageScore(r), combined credit scoring, uses a formula which combines data from all three major credit bureaus to calculate your overall credit score. Your credit score is dependent on many factors including your payment history, credit availability, and other credit information. You can see a significant drop in your credit score if you miss or pay late. You should have multiple lines of credit with varying account types. This will allow lenders to assess your creditworthiness.

Lenders use your credit score to determine whether to approve or deny your credit application. It also determines how much credit you can borrow. Lenders recommend keeping your credit score high to qualify for the best APRs. Good credit can help you get the best cards with the highest rewards and annual statement credits.

Equifax

Your Equifax credit report includes a summary of your credit history. This information may be used to determine whether you are eligible for a loan or college. This report includes information about payment history and account terms. It is important to double-check that your credit reports are accurate. You can contact your creditor to correct any incorrect information. You may also be able to file a free dispute with your credit bureau.

Equifax calculates your credit score using data from all three national credit agencies. This means that your score may differ from that of your credit card company. Lenders will use your FICO score to determine your credit worthiness.

TransUnion

Your credit score is a critical part of your financial life, and there are several ways to raise it. First, make sure to check your TransUnion credit records for any unauthorised account information. You should immediately contact the credit grantor if you find any. Keep track of the date, name, company and follow-up as necessary. TransUnion credit reports will be removed from any inquiry that is found fraudulent.

A good credit score should be between 720 and 780. Your TransUnion credit score can vary depending on the type of credit application and lender. Good credit scores don't guarantee that you will get a loan or credit card approval. But, they can provide greater freedoms and flexibility.