A mortgage application will be evaluated based on your credit history. This report not only shows the quality and amount of your past payments, but it also provides information to lenders about your debt/income ratio. Negative credit reports can make it difficult to qualify for a mortgage. A home loan is only possible if you have at least two consecutive years of good credit. Negative credit history such as vehicle repossessions, late payments and home foreclosures are kept on your credit report for seven-years regardless of whether the account balance was paid.

Average age of accounts

Your average age of accounts (AAoA), plays a significant role in determining your mortgage eligibility. If your average account age is too high, you may lose your mortgage application. Your AAoA will be affected by how many accounts you have. You can try to lower your AAoA by closing older accounts and opening new ones.

Your AAoA is based on the oldest and newest accounts on your credit report. Your score will drop the older your oldest account. To determine your AAoA, review your credit report. This shows all of your accounts open and the dates that they were opened. It is possible to calculate the average age for accounts by adding up the two oldest accounts, and then multiplying it with the number of open accounts.

VantageScore

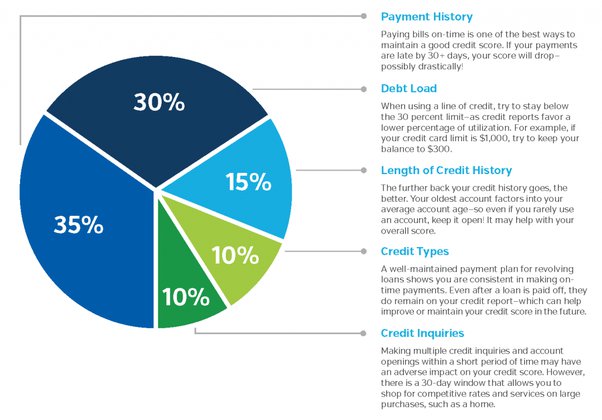

Your credit score is dependent on several factors including your payment history as well as your age. It is also important to consider the length of credit history. The better your credit history is, the longer it is. Credit management is key to improving your score. Lenders prefer people with longer credit history, and VantageScore emphasizes this fact.

You must pay all bills on time to improve your credit score. If you're unable or unwilling to make your monthly payment on time, you can set up automatic payments, reminders, and reminders so that you don’t miss a single payment. Be sure to inform your lender if you suspect you will be late. Most lenders won't report missed payments to credit bureaus if they are notified in advance.

FICO(r)

A FICO(r) score is a numerical rating of a borrower's creditworthiness. It is calculated by looking at a credit report from any of the three major consumer bureaus. The score is calculated based on the payment history of a borrower, as well as the total amount of credit outstanding. The FICO(r), which is a key factor when determining whether or not a borrower is qualified for a loan, is important.

While banks have been requiring FICO scores for mortgages, they may soon face competition. VantageScore competes with FICO. It can be used in the same way as FICO, but it is more commonly used by investors for packaged consumer loan packages. It is also used by lenders in loan securitizations.

VantageScore needs one month's credit history to get a FICO (r) score

When shopping for a mortgage, one of the first things you should do is check your credit score. A low credit score can make it difficult for you to be approved for a loan. Two credit scoring systems can be used to determine your credit score: VantageScore and FICO. FICO is the most common score and the one that you will be using. VantageScore, a more recent system, is promoted by the three credit bureaus.

VantageScore calculates a credit score using credit data. It can range from 350 to 800. Unlike FICO, the VantageScore score can be calculated even if you only have a month of credit history. To be eligible for a loan with FICO(r), you must have at most one month credit history.

No credit history needed to obtain a mortgage

You can still be approved for a mortgage loan even if your credit score isn't great. If you have poor credit, it is possible that you have missed payments or taken on too many debts. Your credit score can be damaged by foreclosures or bankruptcy. It's possible to get a mortgage even though you have poor credit.

First, lenders will need to verify that you can pay the upfront cost and make the monthly mortgage payments. This will convince lenders that the loan can be repaid. To build your credit score, you will need to have a credit history.